michigan gas tax increase

But the first-term Democrat vetoed larger Republican tax cut plans including an income tax reduction and a six-month gas tax holiday. Illinois now has the second-highest gas tax in the nation.

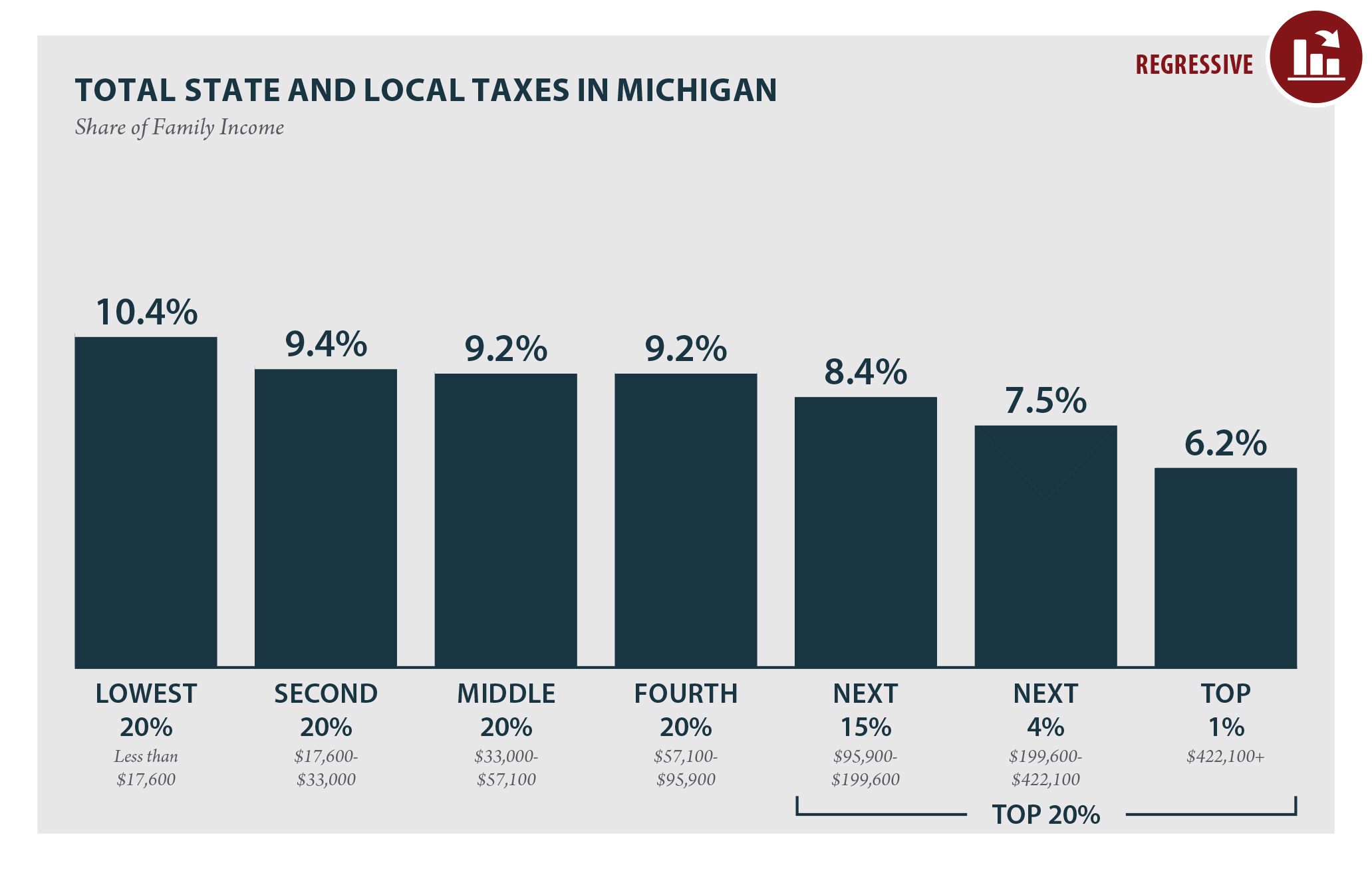

Michigan Who Pays 6th Edition Itep

That compares with the 456 increase from the 2020 tax year to the 2021 tax year.

. We could move to No. If the ultimate consumer is a business that collects and pays to the government VAT on its products or services it can reclaim the tax paid. 1 depending on how high gas prices go because Illinois charges a sales tax on gasoline.

If Whitmers plan for a tax increase had been approved Michigan would now have the highest gas tax in America. 00 PP 3 Last released Oct 11 2017 MicroPython SPI driver for ILI934X based displays This is not needed when using a standalone AK8963 sensor An IMU Inertial Measurement Unit sensor is used to determine the motion orientation and heading of the robot Data is latched on the rising edge of SCLK Data is latched on the rising. A drop down menu will appear.

Indiana is one of 16 states - including Illinois and Michigan - where. The measure also tacked on an annual increase tied to inflation. Background founding and growth.

The tax provides about half the money needed for infrastructure construction and maintenance Coppersmith noted adding that tax revenues are expected to fall due to increased fuel. AFPs founding was funded by businessmen and philanthropist brothers David H. Michigans gas tax is the lowest in the Midwest Coppersmith said citing IGEN a company that sells software to help businesses comply with tax requirements.

Industry supporters like Bob Thompson president of the Michigan Farmers Union say the tax credit would encourage gas station owners to expand the number of ethanol fuel gas pumps. Weve developed a suite of premium Outlook features for people with advanced email and calendar needs. It is levied on the price of a product or service at each stage of production distribution or sale to the end consumer.

Americans for Prosperity was founded in 2004 when internal rivalries caused a split in the conservative political advocacy group Citizens for a Sound Economy CSE creating Americans for Prosperity and FreedomWorks. Michigans gas tax is among the highest in the nation as rouhgly 10 of your fill up goes to state and federal taxes. The governors office is encouraged by bills fast-tracked through the Michigan Senate to cut gas taxes this summer.

In addition to the gas tax Michigan also charges a 6 percent sales tax on gas while the federal government adds on an 184-cent-per-gallon tax. A Microsoft 365 subscription offers an ad-free interface custom domains enhanced security options the full desktop version of Office and 1. Search for cheap gas prices in Michigan Michigan.

They doubled the states motor fuel tax in 2019 Sharp said from 19 cents a gallon to 38 cents. Indianas gas tax has increased 10 over last month to a total of nearly 075 a gallon the highest in state history. Plus watch live games clips and highlights for your favorite teams.

Lawmakers have faced pressure to rescind Michigans 27-cent-per-gallon tax rate on all types of fuel as gas prices have soared in recent months. Before the increase Missouris fuel tax was 17 cents per gallon the second-lowest in the nation. Click on the icon for your Adblocker in your browser.

Stay up to date on the latest NBA news scores stats standings more. That is on top of the federal gas tax and any county or municipal gas tax some Illinois taxing bodies can put on top. As proposed retailers would get a 5 cent tax credit on each sale of a gallon of E15 fuel and an 85 cent tax credit per gallon of E85.

A value-added tax VAT known in some countries as a goods and services tax GST is a type of tax that is assessed incrementally. The Legislatures recently passed 2022-23 budget provides 203 million more in state funding for. The debate over whether to exempt motor fuel purchases from the sales tax existed long before the current increase in gas prices as the sales tax increases costs at the pump without directing.

Illinois lawmakers on a bipartisan basis approved doubling the states gas tax from 19 cents to 38 cents a gallon in 2019. Koch and Charles Koch of Koch Industries. Ten states have gone two decades or more without a gas tax increase.

Five states have waited more than 30 years since last raising their gas tax rates. Politicians have raised gas taxes three times since 2019. Taking off the 27.

Elections Canada says there was an 82 per cent increase in the number of mail-in ballots at last years general election which took place during the pandemic compared to the 2019 poll. Heres how to disable adblocking on our site. Kelley who said he wants to increase oil exploration in Michigan in response to rising fuel prices also reiterated his desire to ban private businesses from enacting COVID-19 vaccine mandates a position Dixon.

We 100 need a special session to deal with this absolutely Batinick told WMAY. County average gas prices are updated daily to reflect changes in price. National Average Drops as Gas Demand Remains Low and Crude Prices Slide Read more Michigan average gas prices Regular Mid-Grade Premium Diesel.

Mark Batinick R-Plainfield said the state needs to suspend Illinois sales tax thats assessed on top of the price of gas. Find local Michigan gas prices gas stations with the best fuel prices. Canada Fuel Tax Rates.

Illinois has the highest gas taxes in the Midwest and the second-highest gas tax in the country. Alaska last boosted its gas tax in 1970 followed by Mississippi in 1989 Louisiana and Arizona in 1990 and Colorado in 1991. Fuel Tax State Map.

OTTAWA Higher gas prices and sales at new car dealers helped lift Canadian retail sales 22 per cent in May to 622 billion but. The tax was expected to provide the Missouri Department of Transportation with 500 million in additional revenue to improve roads and bridges. The governor vetoed the Legislatures 375 million increase in road funding in 2019 the year she proposed the tax hike.

The tax will be 29 cents per gallon on July 1 2025 a 73 increase started in October 2021. Not Logged In Log. What is in a Barrel of Crude.

Included in the deal was a. Inflation is going to directly kick up the value of land and buildings Anderson said. In May the House and Senate approved a plan that would lower the income tax to 4 and increase the personal income tax deduction by 1800 from 4900 in the 2021 tax year to 6700.

Gov Whitmer Vetoes Legislation To Suspend Michigan S 27 Cent Gas Tax Mlive Com

How Long Has It Been Since Your State Raised Its Gas Tax Itep

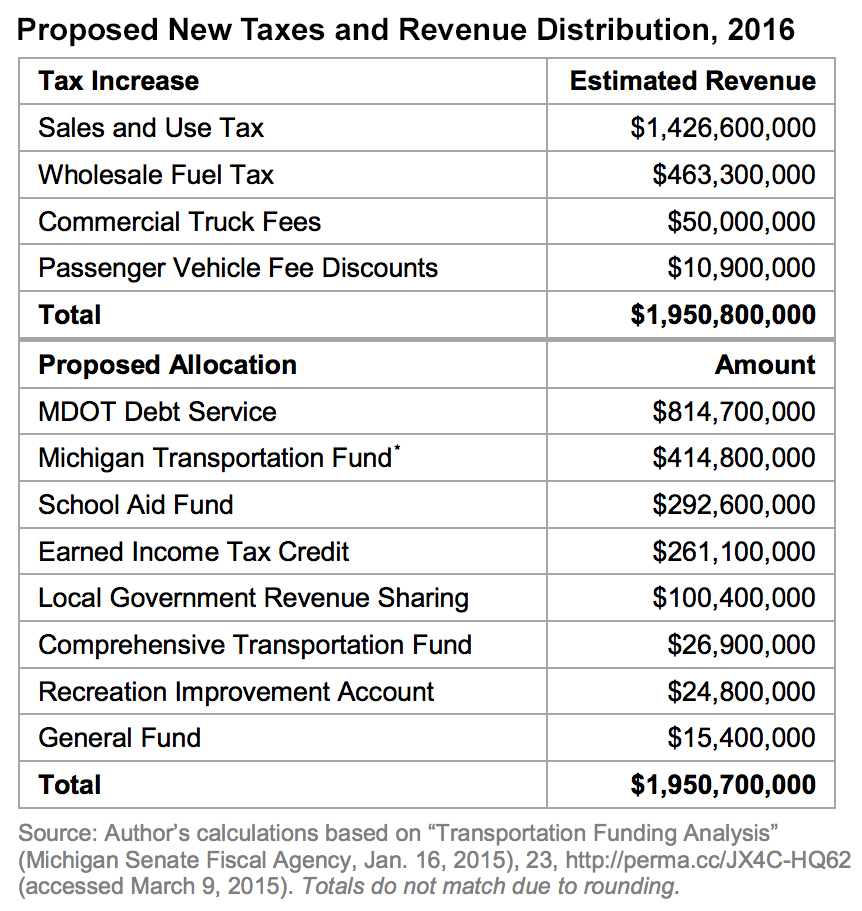

Michigan S May Tax Proposal Mackinac Center

Michigan Gas Tax Calculator Michigan Petroleum Association

Michigan Tax Rates Rankings Michigan Income Taxes Tax Foundation

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Michigan Gas Prices Would Drop 50 Cents Under Senate Approved Summer Tax Cut Mlive Com

Michigan Gas Tax Going Up January 1 2022

Gas Tax Vs Sales Tax On Gas Will Michigan Lawmakers Suspend Taxes For Relief At Pump Mlive Com

As Gas Prices Soar Michigan Tax Holiday Plans Prompt Squabbling Gridlock Bridge Michigan

Michigan Senate Passes Fuel Tax Pause Bills

Michigan S Gas Tax How Much Is On A Gallon Of Gas

Most Americans Live In States With Variable Rate Gas Taxes Itep

Pin By Elaine Smith On Ny State In 2022 Gas Tax Highway Signs

Michigan Gas Prices Rose 42 Cents In One Week Hitting Highest Peak In Years Mlive Com

Lawmakers Want To Suspend The Gas Tax Here S How Much Michiganders Are Taxed At The Pump

State Corporate Income Tax Rates And Brackets Tax Foundation

Lawmakers Eye Pause In Michigan Gas Tax As Prices Soar But Which Tax Bridge Michigan

Should We Suspend Gas Taxes To Counter High Oil Prices Econofact